When Belgium’s social security system celebrated its 70th anniversary, Belgium’s Federal Public Service (the federal ministry) Social Security launched a campaign titled “one for all, all for one”. The objective of the campaign was to mark the 70th anniversary, but this was seen as an opportunity to remind the Belgian population that their social security is their common good.

In Belgium, and in other countries with well-developed public social security schemes, social security still enjoys broad popular support, but is somewhat taken for granted and, at the worst, seen as a distant, cold bureaucratic apparatus. The fact that these systems are the result of a long history of grassroot initiatives and advocacy by various popular movements has become a distant memory. One of these movements is the mutualist movement, a movement that continues to play an important role in the development of social protection worldwide.

A brief history of mutualism

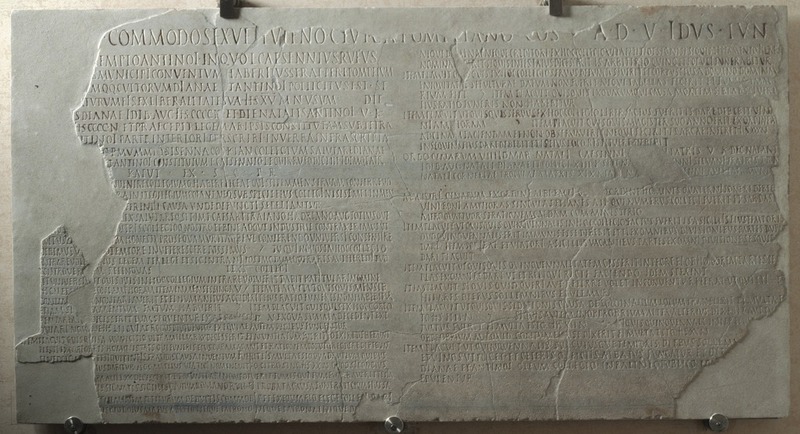

Mutual and cooperative insurance has a long history. During the Middle Ages guilds and similar professional corporations provided a mutual insurance fund that paid allowances for the funeral of their members. As a matter of fact, fraternal burial societies already existed in ancient Rome. The by-laws of one burial society, the lex collegia salutaris Dianae et Antinoi (“By-laws of the Society of Diana and Antinous”), are preserved by an inscription dating to A.D. 136. It details the cost of joining the society, monthly fees, regulations for the burial of members, etc.. Mutual old-age insurance (probably due to the low probability) and mutual health insurance (likely due to the high incidence) did not exist or were at least too rare for us to find any trace of it.

During the 19th century providence and mutual insurance associations were created by professional, religious and political groups. They were based on the principle of reciprocity and risk compensation: in return for the regular payment of a contribution, their members received, in the event of illness or disability, a – modest – daily allowance which partially covered their loss of salary. Most of them also paid funeral expenses. From the 1880s, mutual insurance associations also started to provide old-age, widow and orphan pensions.

Initially they were not that successful since the contributions collected on the basis of rather modest wages were necessarily very low, and as a result the compensations that were being paid out were practically of no use. This obviously undermined the popularity of these initiatives. But they became gradually more successful towards the end of the 19th century. The second industrial revolution reduced food prices, allowing more workers to participate and to contribute more, and at the same time governments began to implement the necessary legislative framework and started to provide subsidies to promote mutual insurance associations.

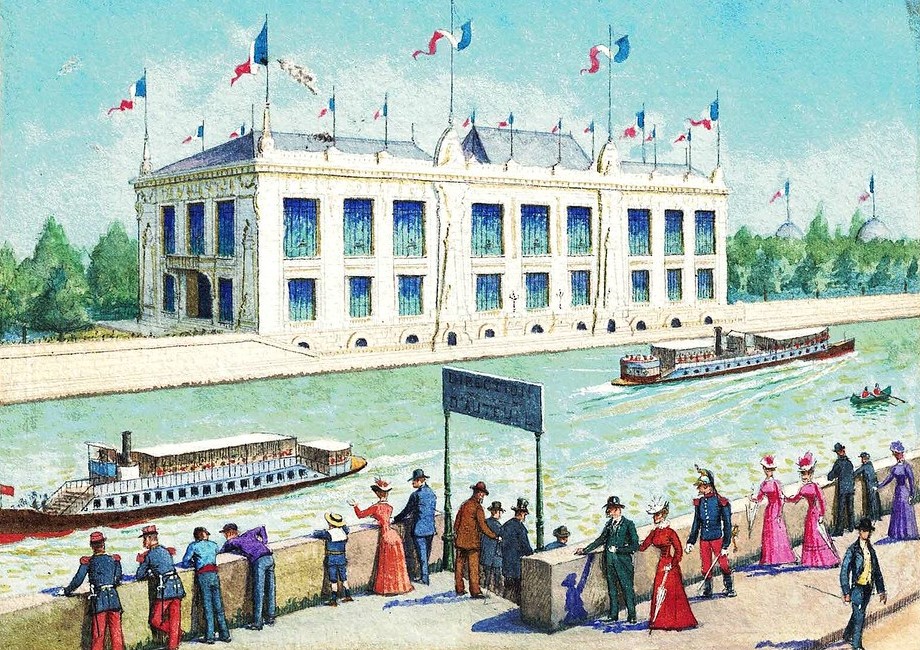

The heyday of mutualism was around 1900. They were particularly successful in the UK (11.5 million insured in 1898) and France (3.5 million insured around 1914). In 1900, Jules Arboux, secretary general of the French Ligue nationale de la prévoyance et de la Mutualité, observed that Belgium, France, Italy, the Netherlands, Switzerland, the UK, and the US choose mutualism as the main way to provide social protection to their citizens. Mutualism became a powerful international movement. In 1906 the International Federation of Mutual societies was founded, a predecessor of today’s International Cooperative and Mutual Insurance Federation (ICMIF: https://www.icmif.org/).

Still of vital importance today

Historically, mutuals were important pathbreakers, as they developed new insurance initiatives and closed (social) protection gaps. Their advocacy had an important impact on the development of social protection in the world. In fact, today’s mutuals and cooperative insurers are equally important in many parts of the world. They remain very instrumental in providing social protection. According to ICMIF worldwide over 990 million people are currently served as member/policyholders by mutual/cooperative insurers.

Mutual insurance initiatives play an important role in low and middle income countries with a widespread informal economy. In these countries formal social security arrangements are almost absent for a large part of the working population. In some countries the state’s capacity to reach the vast majority of the poor people may be limited because of its limited infrastructure and resources. In such a context, mutual microinsurance initiatives are an important way to provide for social protection, including health-care, to a population that is otherwise unprotected.

A beautiful example is SEWA in India. SEWA, the Self-Employed Women’s Association (http://www.sewa.org/), is a trade union of poor, self-employed women workers in India. These are women who earn a living through their own labour or small businesses. These workers make up a large share of the Indian labour force but are an unprotected and vulnerable population. They do not obtain regular salaried employment with welfare benefits like workers in the organized sector.

SEWA was founded during the 1970s and currently provides a broad range of supportive services to its members: health education and care, child care, legal aid, a cooperative bank, and cooperative insurance. SEWA created VimoSEWA, an integrated insurance program aiming to provide social protection for SEWA members, as well as their families, covering their life cycle needs and the various risks and calamities that result in loss of work, income and assets for poor working families. VimoSEWA provides insurance for illness, widowhood, accidents, but also for fire, communal riots, floods, etc.

VimoSEWA’s mission is to provide comprehensive microinsurance services in a manner that is both financially sustainable and promotes decision-making and control by women workers of the informal economy. It is a cooperative organisation, and its members are the users, owners and managers of all services.

There are of course many other mutual microinsurance initiatives in India, both in the domain of old-age pensions (UTI, SEWA, COMPFED) and healthcare (e.g. DHAN). And India is of course not alone, as mutual microinsurance schemes are developing in many countries, covering all continents. The International Cooperative and Mutual Insurance Federation (ICMIF) launched the ICMIF 5-5-5 Mutual Microinsurance Strategy https://www.icmif555.org/ This strategy is aimed at providing five million households with insurance cover and to build resilience in poor communities in five countries: India, The Philippines, Kenya, Sri Lanka and Colombia.

Video explaining how the DHAN Foundation’s health microinsurance policy is helping poor communities in India

And, last but not least, mutual insurance initiatives are also promoted by the “Strategies and Tools against Social Exclusion and Poverty” (STEP) programme of the International Labour Organization. STEP aims to extend the coverage and effectiveness of social protection throughout the world and promotes the design and the implementation of innovative systems of social protection for excluded populations.

Read more about STEP: https://www.ilo.org/asia/areas/WCMS_124725/lang–en/index.htm